How to save for vacation: 9 Tips to Reach Your Travel Goals

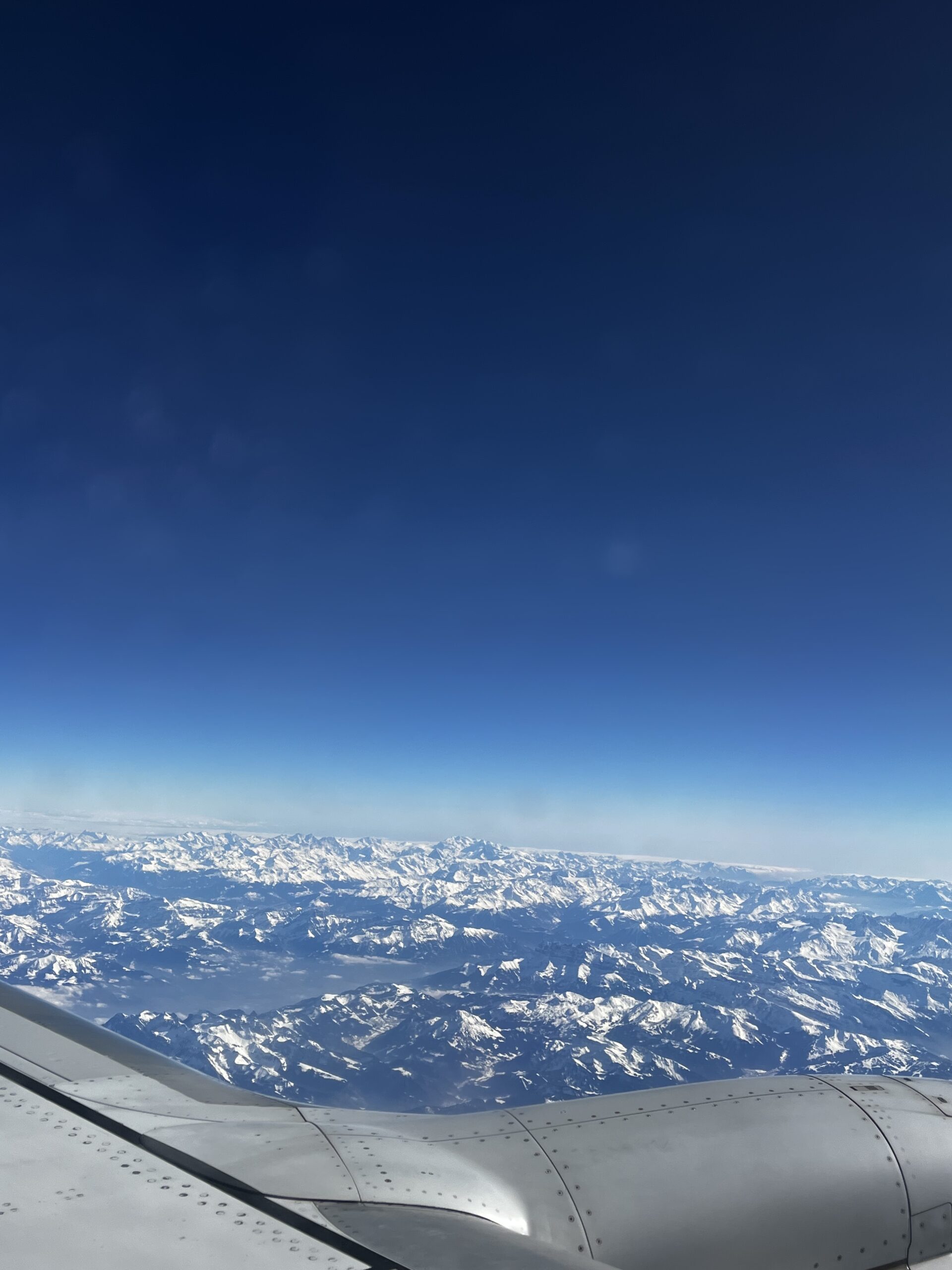

Before we took the leap to start our travel journey, saving for the trip often felt hard and confusing. The costs of flights, hotels, and everything else made it feel out of reach, and we didn’t really know how much we should try to save. When we finally started putting a plan into action, we quickly realized that it’s possible to save for a vacation without having to give up everything else. With some planning and the right strategies, the dream trip can be much closer than you think. To help you get there, we’ve put together 9 practical tips on how to save for vacation that make saving simple, beginner-friendly, and achievable without drastic sacrifices or complicated systems.

Just so you know: This post may contain affiliate links. That means we might earn a small commission if you book or buy something through the links – at no extra cost to you. It helps us keep sharing travel tips for budget adventures!

1. Set a Clear Goal for Your Vacation Savings – The First Step In How To Save For Vacation

Before you start saving for your trip, it can be helpful to know exactly what you are saving for. Getting specific about where you want to go, what you want to do and when sets up the ground before you can plan for your vacation effectively. Once you have this in mind, it becomes much easier to plan your budget and start saving for it. Check out our Travel Plan Checklist, to make the process even easier.

Decide Your Destination and Travel Dates

First things first, decide where you want to go, your travel style and your planned travel dates. This will help you set your budget since different destinations and travel styles vary when it comes to costs. Your travel style, like the type of accommodation you prefer, how to get around or the activities you want to do, combined with your destination and travel dates, will determine your overall budget. Once you have a clear picture of this, it will be easier to know how much you need to save for the trip.

Choose the Travel Style That Fits Your Budget

Think about how you want to travel. Do you want luxury, mid range or budget traveling? Your travel style will affect everything from where you stay, what activities you’ll do and how you get around. Here, you can also decide what you are willing to spend less on or what is a non-negotiable thing. For example, if you know you’d rather save on accommodation so you can spend more on experiences, you can plan for that.

If you want to save on accommodation, check out our guide on finding cheap accommodation that is filled with tips on budget friendly stays without having to sacrifice comfort.

Estimate All Travel Costs in Advance

Now its time to put the numbers down. Even if you don’t have the exact prices yet, make a rough estimate of your main expenses:

- Flights or transport – plane tickets, trains, buses, or rental cars.

- Accommodation – hotels, hostels, or vacation rentals.

- Meals and snacks – eating out, groceries, and coffee stops.

- Local transport – taxis, shuttles, buses, or metro passes.

- Activities and experiences – tours, entrance tickets, or special adventures.

- Travel essentials – passports, visas, vaccinations, travel insurance, and international SIM cards.

- Souvenirs & shopping – gifts, local crafts, or personal purchases.

- Other expenses & emergency buffer – unexpected expenses, tips, or minor emergencies (set at least 10-15% of total budget).

Make sure to budget a little higher than you think you’ll need as it often easy to spend a bit more than you think. And you’ll also be covered incase prices go up or if you want to add something extra to your trip.

Also make sure to have an emergency buffert. Set aside at least 10-15% of your total budget for different unexpected costs that can occur. Once you have your estimates, you’ll know exactly how much to save, and suddenly your vacation shifts from “someday” to a clear goal.

2. Create a Dedicated & Automated Vacation Fund

Open a Separate Savings Account for Your Trip

One of the easiest ways to make sure your vacation money doesn’t get mixed up with everyday spending is to open a separate savings account just for your trip. If available in your country, a high-yield savings account can help your money grow slightly faster than a regular account. Having a dedicated account also gives you a mental boost, you’ll see the balance grow and know it’s only for your upcoming trip.

Automate Your Savings to Make it Easy

Instead of waiting until the end of the month to see what’s left over, set up an automatic transfer to your vacation account if you have the possibility for that. It could be weekly or monthly, whatever fits your budget. Even small amounts add up quickly when you’re consistent, for example $5 a day = $1,825/year. Think of it like paying yourself first: treat your vacation fund as a non-negotiable bill.

Track Your Vacation savings Progress

Keeping an eye on your savings is motivating. You can use budgeting apps that link to your account, or just keep a simple spreadsheet where you track deposits. Watching your balance move closer to your goal makes the trip feel more real and keeps you on track.

3. Build a Practical Vacation Budget

Break Expenses into Clear Categories

Before you start saving, map out what your vacation will actually cost. Break it into clear categories like flights, accommodation, food, transport, and activities. Decide what’s a “must-have” (like flights and a safe place to stay) and what’s a “nice-to-have” (like extra excursions or fancy dinners). Don’t forget to add an emergency buffer of about 10–15% for surprises or emergencies.

Track Spending and Adjust as Needed

Once you know your categories, track how much you’re spending and saving each month. Review your progress regularly, maybe once a month. If you’re ahead of schedule, you can add a little to your “fun” budget. If you’re behind, cut back in other areas and reallocate funds to your must-haves.

4. Cut Everyday Expenses to Save for Your Next Vacation

Reduce Daily Costs

One of the easiest ways to save for travel is by cutting small, everyday expenses that add up. Cancel unnecessary subscriptions, cook at home instead of eating out, and limit impulsive purchases. Being more mindful of your spending can save you a significant amount of money over time.

Use Cashback & Rewards Apps

There are cashback apps and credit cards that give you rewards on everyday purchases. If you put those rewards straight into your vacation fund, your savings will grow faster with almost no extra effort. Just make sure you’re not overspending just to earn rewards, otherwise the rewards won’t really be worth it.

Track Daily Spending

Tracking your spending in real time makes it much easier to stay on top of your budget. Set daily or weekly limits and even turn it into a challenge, try to stay under budget and treat it like a game to keep yourself motivated.

5. Boost Your Income and Learn How to Save for Vacation Faster

Exploring side hustles, freelancing, or passive income ideas is a smart way to save for vacation faster and more effectively. To learn more about different ways to make money online, read our guide here.

Side Hustles & Freelancing for Extra Travel Cash

If you have a skill or talent, consider freelancing. If not, simple side jobs like babysitting, selling things you no longer need (like clothes), or renting out items such as tools can also help you save more for your trip.

Passive Income Ideas That Support Your Vacation Goals

If you prefer to earn money in the background, consider setting up passive income streams. This could be creating digital downloads, templates, or print-on-demand products. It takes some effort upfront, but once running, the earnings can go straight into your vacation fund without ongoing active work.

6. Creative Ways to Supercharge Savings

Try a No-Spend Challenge for Extra Savings

Challenge yourself with a 7-day or 30-day no-spend challenge, where you avoid non-essential purchases. Make it fun by involving friends or family, and see who can keep the challenge going the longest.

Use Financial Windfalls to Grow Your Fund

Got a tax refund, work bonus, or birthday money? Instead of spending it, send it straight to your vacation fund. These unexpected extras can help you reach your goal much faster.

Sell Unused Items and Turn Clutter into Cash

Turn clutter into travel money by selling things you don’t use anymore. Platforms like Facebook Marketplace and Vinted make it easy to clear space and boost your savings at the same time.

7. Use Points, Rewards & Loyalty Programs

Membership & Discount Cards That Save You Money

Many stores, student associations, or even workplaces offer perks you might not realize. For example, grocery store memberships, student cards, or employee discount programs can give you access to cheaper hotel stays, discounted transport, or special travel deals. It’s worth checking what benefits you already have before booking.

Airline Miles & Hotel Points

Signing up for airline and hotel loyalty programs is often free and can provide perks like discounted rates, upgrades, or points toward future stays. Over time, using these programs strategically can help you save money on travel without needing to spend extra.

8. Travel Smart with Flexible Plans That Help You Save More

Travel Off-Season for Big Savings

Traveling outside of peak times can save you 30–50% on flights and accommodation. You’ll also avoid the crowds and get a more authentic experience, even if it sometimes means sacrificing a bit of the best weather.

Flexible Dates & Destinations Make Trips Cheaper

If you’re flexible with your plans, you can score better deals. Use flight comparison tools to see which dates or nearby destinations are cheaper. Sometimes shifting your trip by just a few days makes a big difference. Use a flight comparison tool like Kiwi to quickly check which dates or nearby destinations are cheaper.

9. Stay Motivated and Make Saving for Vacation Fun

Visualize Your Travel Goal

Keep your dream trip front and center with a vision board, photos, or countdown apps. Pin pictures of your destination where you’ll see them every day, or set reminders on your phone with motivational quotes. The more real your goal feels, the easier it is to stay committed to saving.

Celebrate Milestones

Reward yourself when you hit savings targets. It doesn’t have to be expensive things, treat yourself to a movie night, a favorite meal at home, or a small treat that feels special. Celebrating milestones keeps the process enjoyable and helps you recognize the progress you’re making toward your bigger goal.

Keep Your Goal in Sight and Stay Committed

Stay focused by reminding yourself why you’re saving. Keeping your goal in mind helps you push through moments of temptation to overspend. Consider writing down your goal or keeping a small journal of your progress, it shows you why your efforts matter and helps you stay motivated.

Conclusion

With small, consistent steps like budgeting, cutting everyday costs, boosting your income, and staying motivated, you can reach your travel goals faster than you think. The earlier you start following these tips on how to save for vacation, the sooner you’ll be packing your bags.